Investment risk

Understand the key risks with investing and how to manage them.

Step 2 will help you with a tricky topic: risk. All investing carries risks, where are essential if you want to make a return. Find out why, and the simple ways to manage them properly.

Understanding risk

What do we mean by risk? Inexperienced investors often think investing is akin to gambling in casinos or betting on a horse, but investment risk can be managed much more carefully and simply. We explain why.

Managing risk - Asset classes

There are different levels of risk associated with different types of investments. Here, we explain what the groups of investment are, known as asset classes.

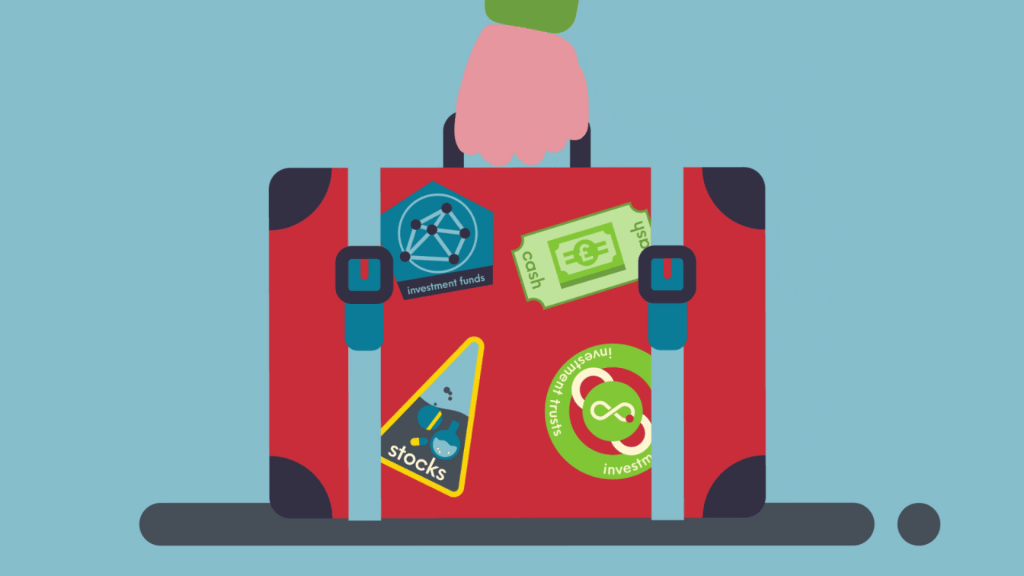

Managing risk - Geography

Investing across different regions of the world is one way of managing the risks in your investment portfolio. We look at why, and some of the different markets around the globe.

Life stories

A range of investors talk about their experiences, and how they have managed risk in their own investment lives.

Key concepts

The key bits of (unavoidable!) jargon used in this Step, busted!

- Understanding risk

- Managing risk - Asset classes

- Managing risk - Geography

- Life stories

- Key concepts